Monte Carlo Predictor MT5

The utility refers to probabilistic analysis tools, in particular the Monte Carlo method.The Monte Carlo method is defined as the simulation of processes in purpose to evaluate their probabilistic characteristics and apply them to the solvable t

The utility refers to probabilistic analysis tools, in particular the Monte Carlo method.

The Monte Carlo method is defined as the simulation of processes in purpose to evaluate their probabilistic characteristics and apply them to the solvable task.

Operation features

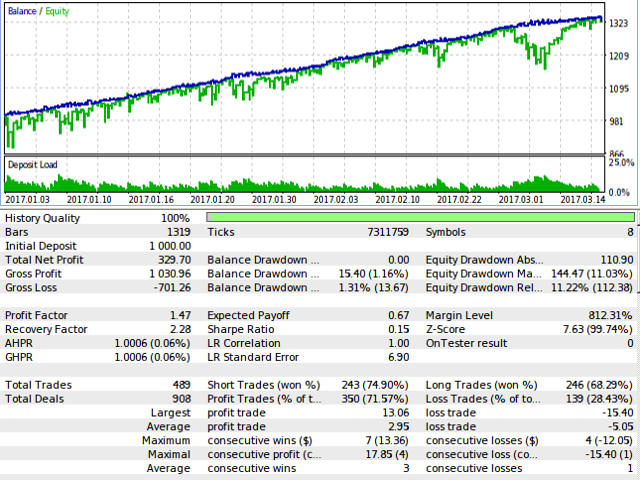

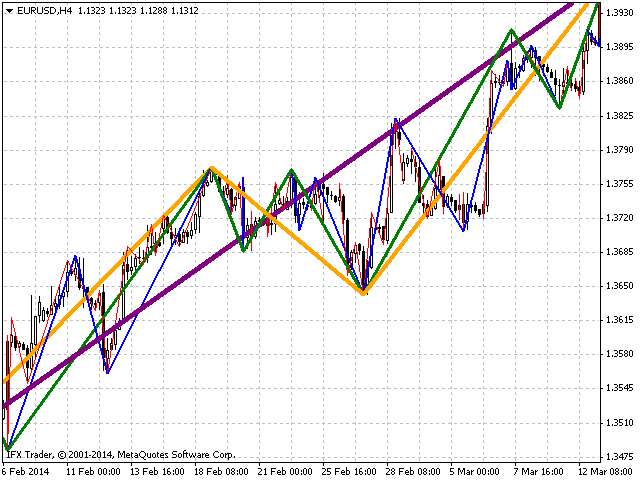

The simulation uses a tick model with the subsequent transformation to the candles form, as a model as close as possible to the real market process.

The utility generates a stream of a random tick sequence until a result with the best similarity to the original sample is obtained, and continues this stream as an expected further development of events.

This method of forecasting is based on synchronization of numerical distribution of the generated instance and the original sample.

Сontrol

The utility is controlled by a single button that has several states:

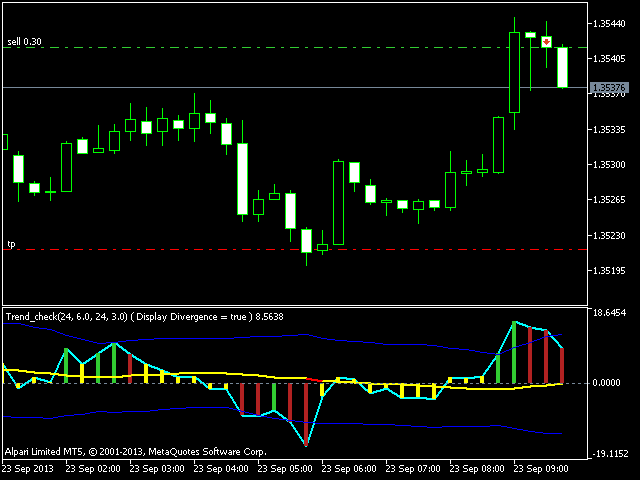

Pause - the utility is idle, pressing the button starts the process and puts the utility in the "Seek" state.

Seek - the utility works and searches for the most suitable instance, pressing the button puts the utility in the "Pause" state.

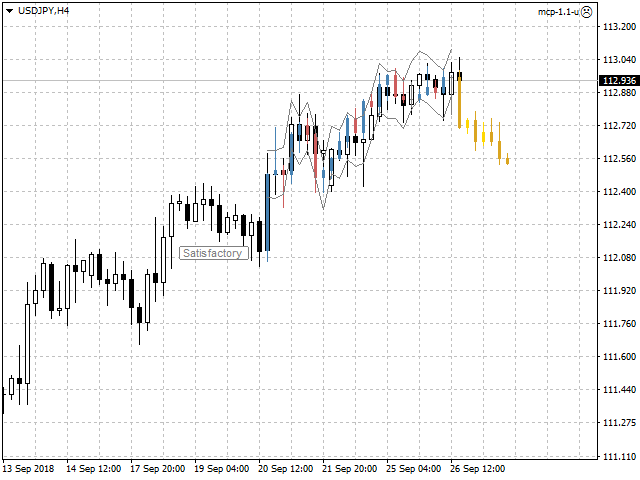

Satisfactory or Wonderfully - the result of verification of the generated instance and the original sample, pressing the button starts the continuation of the process and puts the utility in the "Seek" state.

Input variables

Candles - number of candles taken from the chart as the reference area.

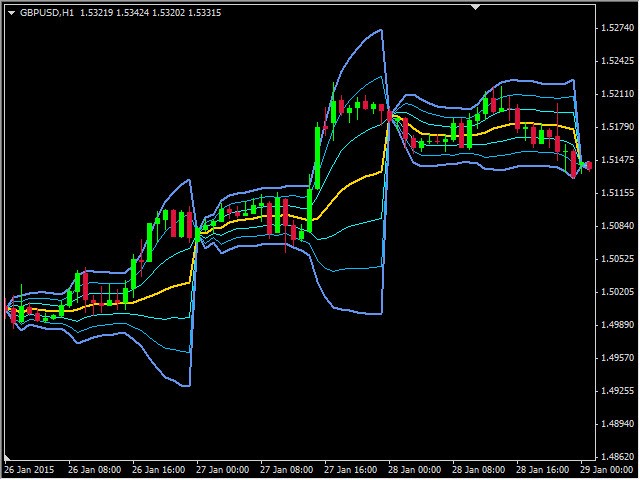

Forecast - forecast size as a percentage of the total volume of the candles of the reference area.

Similarity - similarity criterion, as the number of candles as a percentage of the number of candles of the reference area, is unacceptable to fall outside the channel of reconciliation at closing prices.

Channel - width of the reconciliation channel in standard deviations, as the lower and upper bounds, is unacceptable to fall outside at closing prices.

Scale - multiplier for the tick size that controls the amplitude of the generation.

Norm - volume normalizer, this parameter slightly reduces the quality of simulation, but significantly speeds up the process of finding instances:

for value of 0 - normalization is not performed.

for values over 500 - normalization is performed relative to the total value of the volume columns of the candles of the reference area.

for values from 10 to 200 - normalization is performed relative to the average value of the volume columns of the candles of the reference area.

for values from 200 to 500 - normalization is performed relative to the maximum value of the volume columns of the candles of the reference area.

Shift - shift in history, allows to evaluate and adjust the quality of forecasts on the existing history.

Rand - dimension of the random number generator.

Alerts - notification method when the searching has finished.

Visible - displays the process, always or only when the searching has finished.

Pinpoints - enable/disable the control points when comparing the generated instance and the reference area.

Liquidity - enable/disable the follow of the daily template of tick activity for the forecasted candles.

Volumes - volume scale used in calculations, tick or real.

Other variables are related to color settings, and their purpose becomes clear from their names.

Features of testing trial version

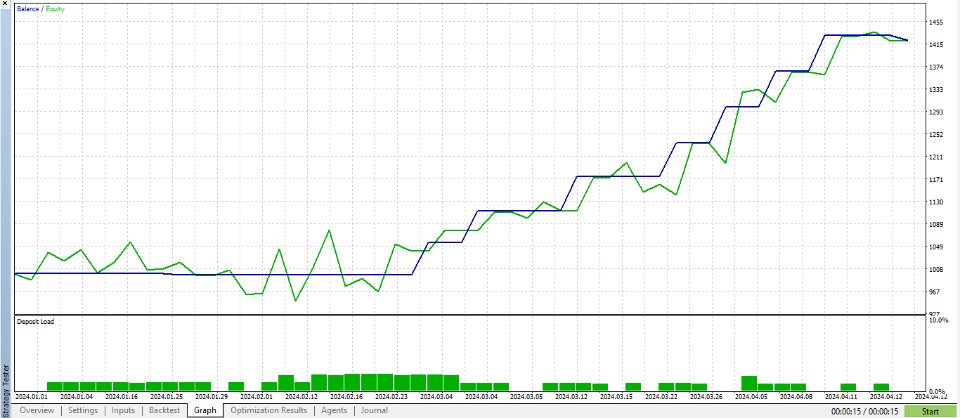

In the strategy tester set the "Every tick" mode.

Adjust the tick rate to approximately no more than one tick per second.

Switch the utility to the "Seek" state and expect the result as a forecast in the form of yellow candles.

Also use the input variable "Shift" according to its purpose.

Useful notes

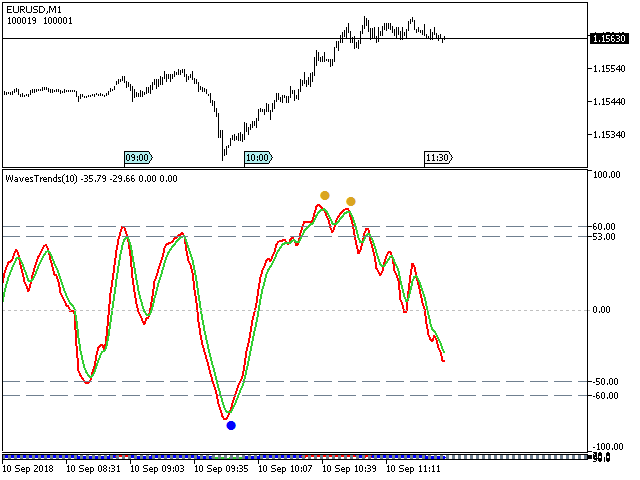

The forecast should not be taken as the ultimate truth.

Also should not to focus on the forecasted candles, as if they already exist.

Pay attention mainly to the direction of the forecast, as well as the intensity of this direction.

Additionally perform a visual verification of the generated instance and the reference area.

Use the utility only as an accessory tool in conjunction with your main trading strategy.