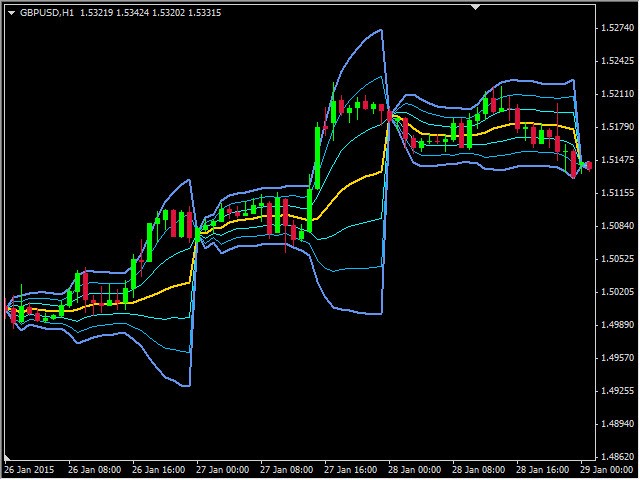

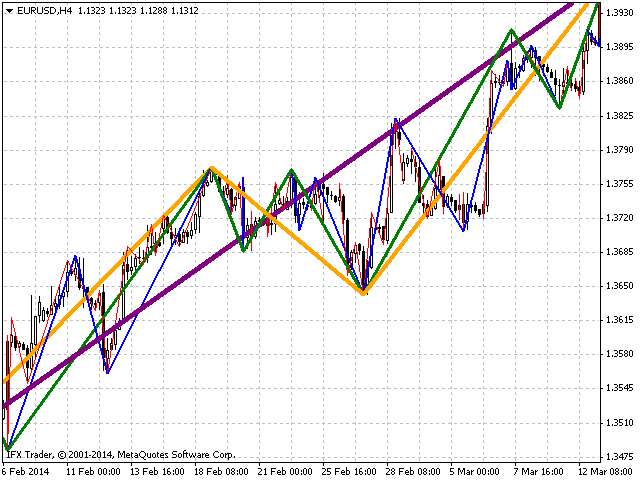

All Time Frames CCI RSI Stochastic

This indicator is based on the classical indicators: RSI (Relative Strength Index), CCI (Commodity Channel Index) and Stochastic. It will be helpful for those who love and know how to use the digital representation of the indicato

This indicator is based on the classical indicators: RSI (Relative Strength Index), CCI (Commodity Channel Index) and Stochastic. It will be helpful for those who love and know how to use the digital representation of the indicators. The indicator shows values from each timeframe (M1, M5, M15, M30, H1, H4, D1, W1 and MN1).

You will be able to change the main input parameters for each RSI, CCI and Stochastic for every timeframe.

Parameters

OverboughtLevel_R = 70 - RSI UpLevel

OversoldLevel_R = 30 - RSI DownLevel

OverboughtLevel_C = 100 - CCI UpLevel

OversoldLevel_C = -100 - CCI DownLevel

OverboughtLevel_S = 80 - Stochastic UpLevel

OversoldLevel_S = 20 - Stochastic DownLevel

Example for M1:

Period1 = 13 - period for CCI and RSI

Price1 = PRICE_CLOSE - apply price for CCI and RSI

K_Period1 = 5 - first period for Stochastic

D_Period1 = 3 - second period for Stochastic

S_Period1 = 3 - slowing period for Stochastic

Method1 = MODE_SMA - MA method for Stochastic