FFF Forts

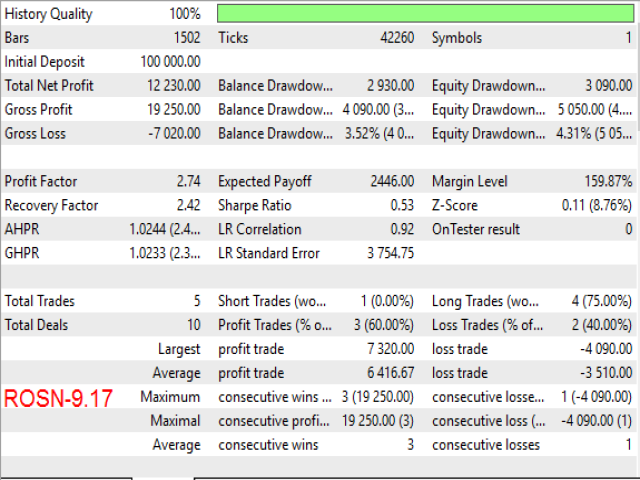

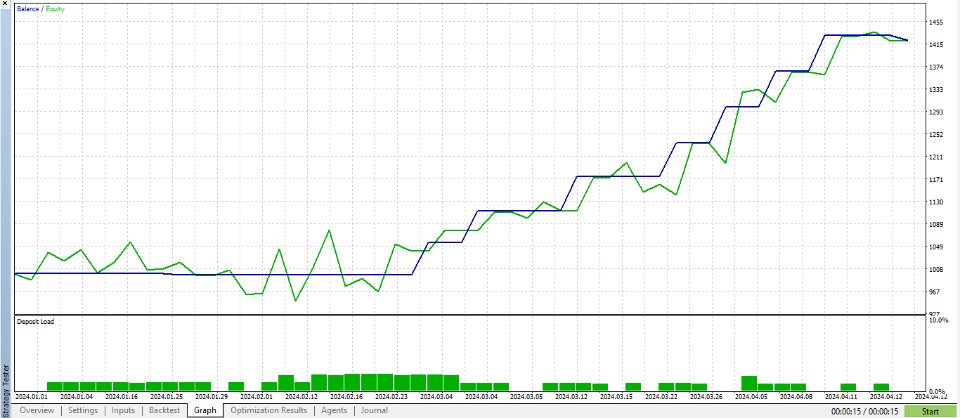

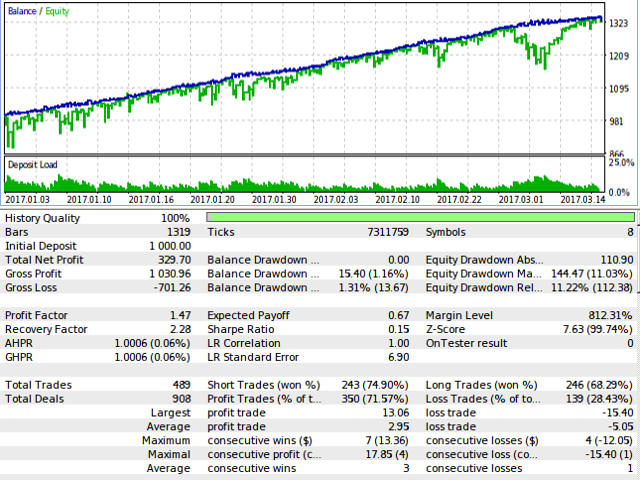

FFF Forts is a fully automated trading robot designed to trade on futures on the Russian derivatives market FORTS (RTS, Sberbank, Gazprom, the Ruble, etc.).The robot trades only with the trend. Trade entry occurs on roll-backs. The size of the r

FFF Forts is a fully automated trading robot designed to trade on futures on the Russian derivatives market FORTS (RTS, Sberbank, Gazprom, the Ruble, etc.).

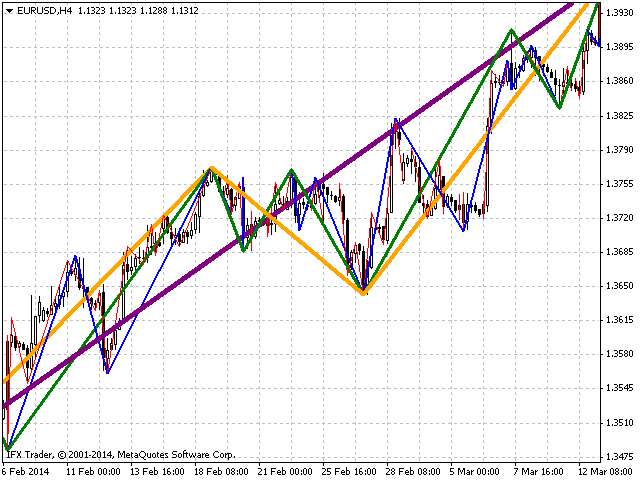

The robot trades only with the trend. Trade entry occurs on roll-backs. The size of the roll-back is determined manually (in points) or automatically based on the volatility of the instrument.

Settings

Type of trade - trade direction

Topping up on a trend - enable/disable adding a trend

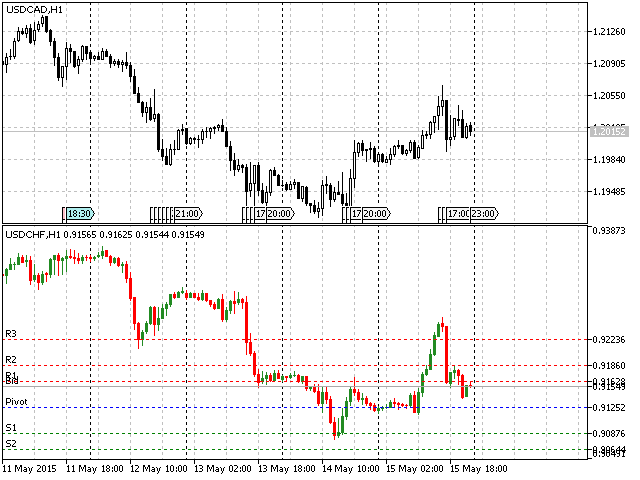

Use Times Filters - enable/disable time limit for trade

Time Filter - setting block trade on the time and day of the week if you have enabled Use Time Filter. With this setup, you can define two time ranges and the days when the EA is allowed to trade

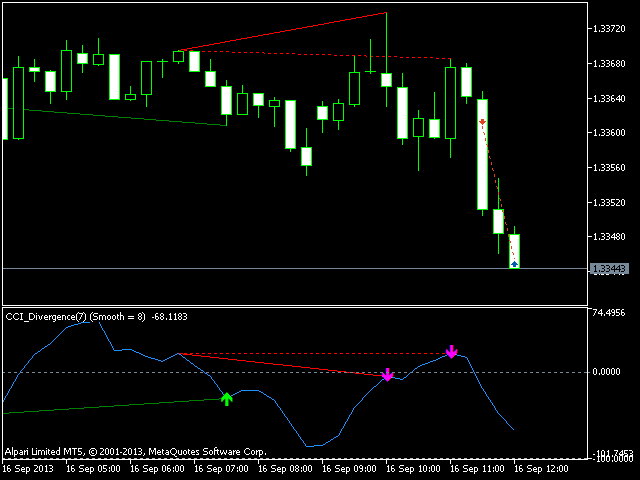

Setting for candles - set the average volatility for the calculation of the entry point, take profit and stop loss

Type - calculating the average volatility: daily, weekly or monthly

Placing order - enable/disable trade with pending orders

Volatility calculation type - select the method of the average volatility calculation (High-Low, Open-Close)

Number of days - Select the number of days involved in the calculation of volatility

Manual input of volatility (0-auto) - manual input volatility

Level of trend change, % - select percentage of average volatility. Once the price moves against the trend by a certain amount, the trade direction is changed

Order level, % - select percentage of average volatility. Once the price moves against the trend to a predetermined value, pending orders are set for the selected levels

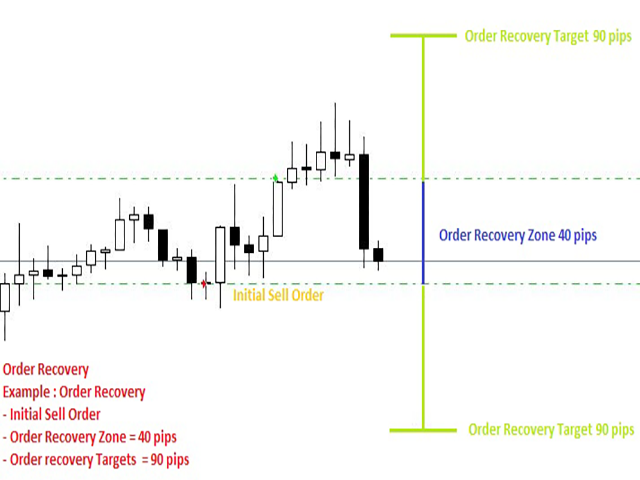

Setting for 1-5 limit order - settings for five pending orders

1 level setting orders, % - select the first level for the pending order in % of the average volatility

Lot for 1 level - lot for the first pending order

SL for level 1,points - stop loss for the first pending order in points

SL for level 1, % Level - stop loss for the first pending order at % of the average volatility

SL for level 1, % Level+points - number of points that should be added to SL for level 1, % Level

SL for level 1,points+LastOrder - total stop loss for all orders

TP for level 1,points - take profit for the first pending order in points

TP for level 1, % Level - take profit for the first pending order at % of the average volatility

Type Candles for TP - calculation method of average volatility for take profit

TP for level 1, % Level+points - number of points that should be added to the TP for level 1, % Level

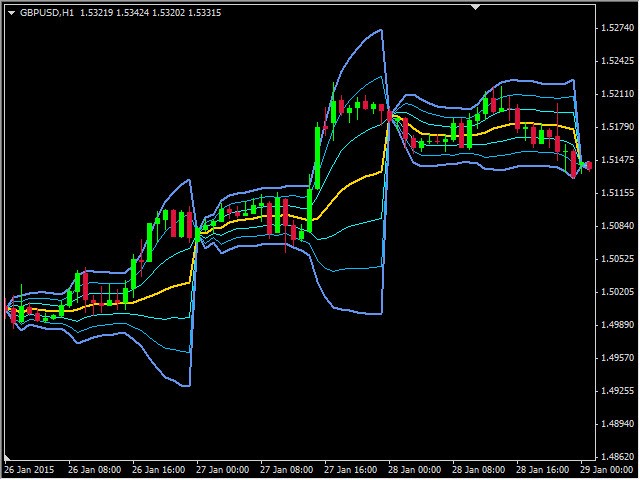

MA Settings - set the moving average

MA Period - MA period

MA Shift - MA shift

MA Method - MA calculation method

Price MA - MA price

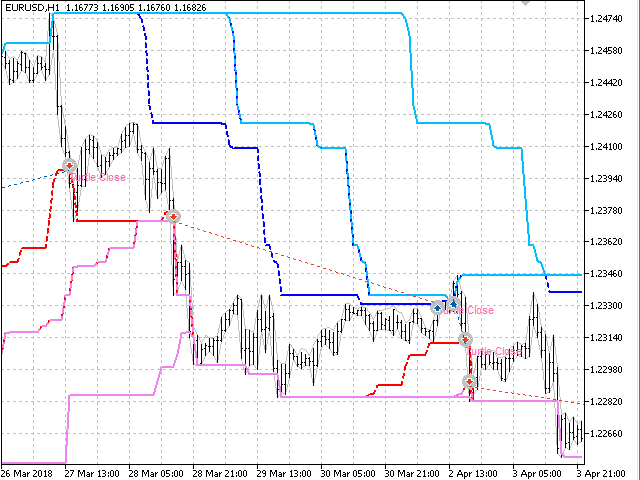

Parameters BreakEven - set the breakeven

Use BreakEven - enable/disable breakeven

BE start, points - start breakeven in pips

BE start % - start breakeven is calculated in % of the average volatility

BE level points - value of an open order, by which a stop loss is moved

Parameters Trailing - trailing stop loss

Use Trailing - enable/disable trailing stop loss

Trailing Stop Level, points - how much the price should pass in points to activate trailing stop loss

Step trailing, points - step of the trailing stop loss in points

Trailing Stop Level, % - how much the price should go in % from average volatility to activate trailing stop loss

Step trailing, % - step of the trailing stop loss in % of the average volatility

Parameters Partial closure - set up partial close orders. You can specify up to five partial closures

Use Partial closure - on/off partial close

Type Candles for Closing - select the method to calculate the average volatility for the partial closure

Closing level 1, points - how many points the price should pass for the first partial closing of orders

Closing level 1, % - how many % of the average volatility the price should pass for the first partial closing of orders

Lot of closing 1 - volume closed at the first partial closing

Other settings - general settings

Max Spread - maximum spread

Number of attempts - number of attempts to open

Slippage - slippage

Magic Number - unique number

Comments - order comment

Color Levels - grid color