Ermou Street

Ermou Street rather than an expert or an indicator is a all-in-one trading assistant easing your trading sessions by providing signals and notifications. It's an assistant rather than a robot - "an assisted steering rather than an autopilot&

Ermou Street rather than an expert or an indicator is a all-in-one trading assistant easing your trading sessions by providing signals and notifications. It's an assistant rather than a robot - "an assisted steering rather than an autopilot", and now, it autoadjusts itself to any instrument, any timeframe & any circumstance.

How to

First, you should watch the video. Then here's some explanation:

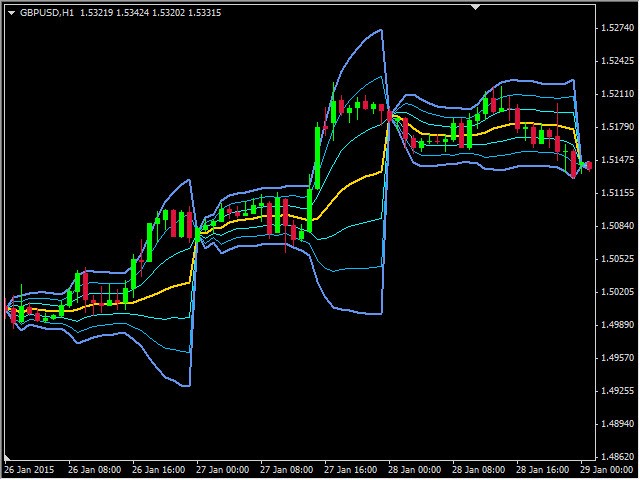

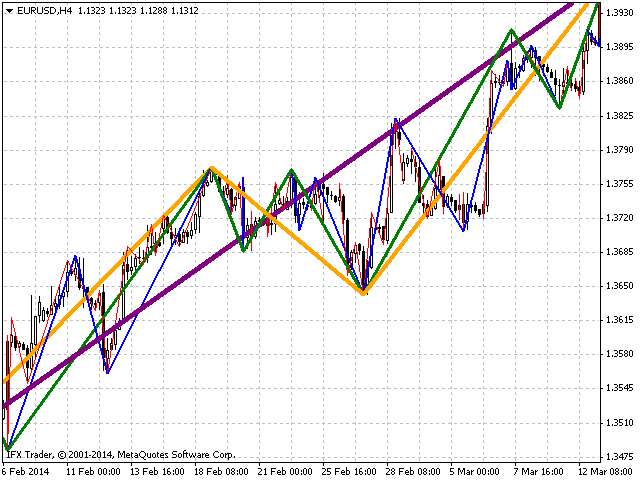

By default, attaching Ermou Street to a chart, you’ll get:

A panel

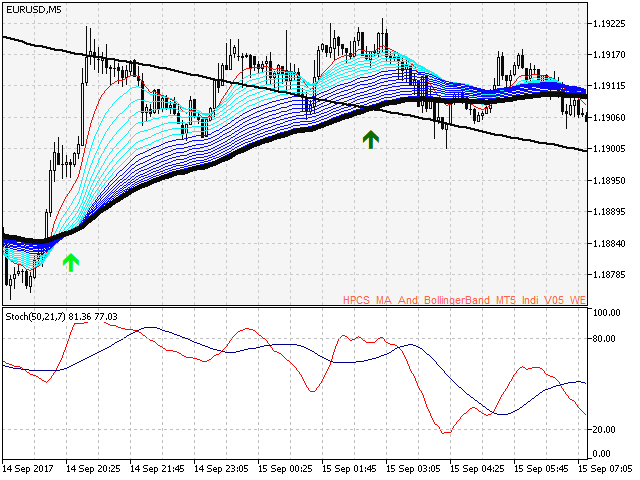

Signals: buy (default blue arrow) / sell (default red arrow)

Back end inputs: these parameters are available from the EA tab:

Bull/Long/Positive ; R1/R2/R3 levels' color: default blue

Neutral ; Pivot: default white

Bear/Short/Negative ; S1/S2/S3: default red

Signal shift in points: shift of 150 points higher/lower than entry candle by default

The panel is organized so - from left to right:

Indicator settings:

Optimize using an interval of x bars: number of bars used to optimize, should be inferior to the chart max bars and superior or equal to 1000

... searching for at least x deals: expected numbers of deals for x bars when optimized - should be superior or equal to 2

... starting parameters search from: value to start research from

... to: value to end research to

... with a step of: step between the above values

Consider volatility: will filter signals using volatility - be aware that then important signals may be omitted

Optimization process: interval, numbers of passes remaining, gain in points by passes, gain in local currency with 1 lot

Run optimization: will start optimizing on selected interval

The best profit in points matching your choice for deal frequency is automatically selected.

Trade settings:

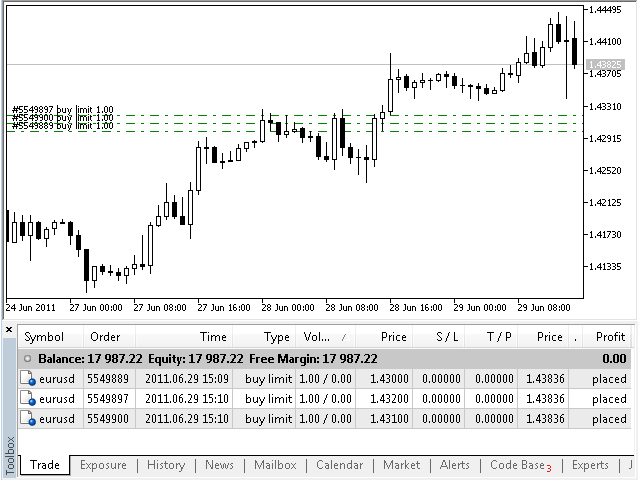

Distance to place orders: the order stop is placed at x points from the signal price (0 - deactivated)

Take Profit in points: distance for taking profit at (0 - deactivated)

Stop Loss in points: distance for cutting loss at (0 - deactivated)

Trailing Stop in points: will follow far of x points a winning deal

Risk in %: for automatic lot size adjustement

Time filtering - day1:from1-to1/day2:from2-to2

Days are: Mon(day), Tue(sday), Wed(nesday), Thu(rsday), Fri(day), Sat(urday), Sun(day), All (everyday)

There are no limitations, many time-slot per days are possible (ex.: Mon:8-9/Mon:15-17/Tue:16-18 etc ...)

Enter "help" inside the box for a memo

Keep synced order pool with signals: no opposite order to new signal will be left in the order pool (ex: signal is now "buy", sell orders are removed)

Autoclose position on trend change: no opposite position to new signal will stay opened (ex: signal is now "sell", buy positions are closed)

Daily pivots: hide - show

Notifications: sound, push, sound and push.

When Ermou Street is attached to a chart, a first optimization is mandatory.

Using 0 as a step, stoploss & trailing reproduces the arrow-to-arrow strategy used to calculate optimization results - it's not more dangerous, as a new signal close automatically the previous one.

ie: BUY - LONG POSITION - BUY - BUY - BUY - SELL (close the position).

When a new signal appears, the levels are automatically calculated, you're notified about and is placed only by clicking the Deal button or from the MT5 app of your phone/tablet. The deal opportunity remains until an opposite signal occurs.

The daily pivots are particularly useful for swing-traders, to adjust stops by yourself (trailing = 0) for example.

Notifications:

Push notification: stay connected with the MetaTrader 5 app

Sound notification

Both: sound & push

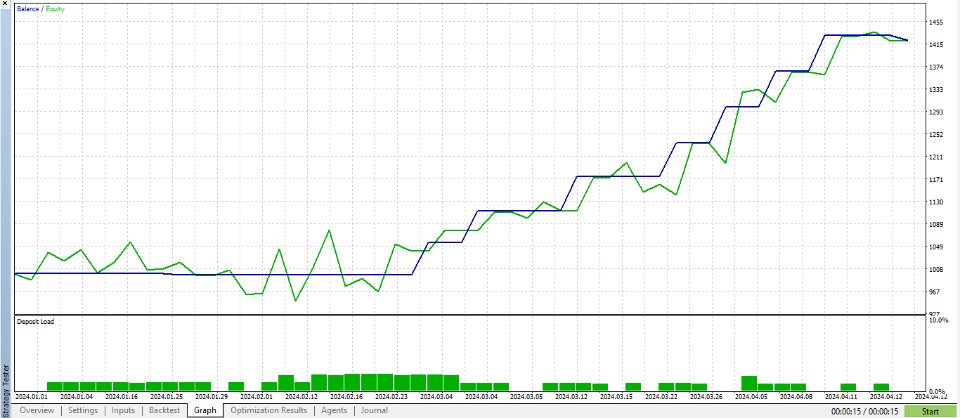

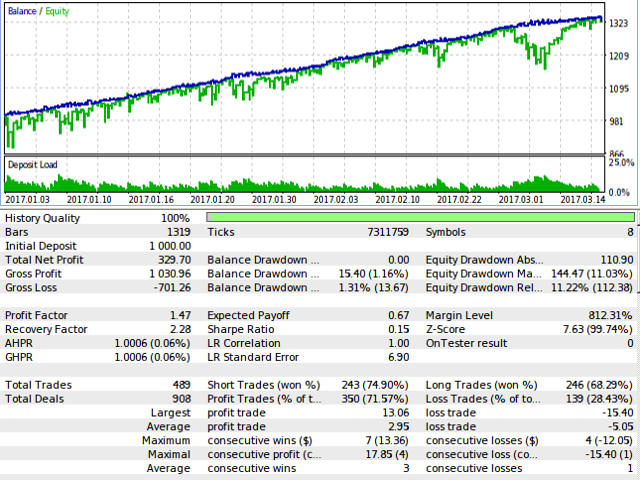

Testing

Testing the EA within the tester is done using an arrow to arrow strategy. To reproduce it in live, you'll just need to set stoploss, takeprofit, trailingstop to 0 & default step value. Depending the selected symbol, timeframe, results may be from excellent to deceiving.

Known bugs

Let me know.

Enjoy!